Hourly payroll calculator with overtime

A Hourly wage is the value. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked.

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Ad Process Payroll Faster Easier With ADP Payroll.

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Get Started With ADP Payroll. The algorithm behind this hourly paycheck calculator applies the formulas explained below.

Call Now For More Details. Learn How to Save 10 Off Our Services Today. Call Now See How We Can Save You Time Money.

First enter your current payroll information and deductions. Ad Track time in the field faster with LASSO. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Process Payroll Faster Easier With ADP Payroll. Track time and tasks by client project or. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. This calculator can help with overtime rates that are 15 and 2 times the rate of the employees base pay. Get Started With ADP Payroll.

Unless exempt employees covered by the Act must receive overtime pay for hours. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. In case someone works in a.

30 x 15 45 overtime. By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. LASSO helps the event industry work smarter.

The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. Enter working hours for each day optionally add breaks and working hours will be calculated automatically. Get an accurate picture of the employees gross pay.

You can enter regular overtime and an additional. All Services Backed by Tax Guarantee. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

No more manual timesheets and cost surprises. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Free Unbiased Reviews Top Picks.

The employees total pay due including the overtime premium for the workweek can be calculated as follows. Free Online Timecard Calculator with Breaks and Overtime Pay Rate. Ad Time To Switch To Digital Time Keeping.

See where that hard-earned money goes - Federal Income Tax Social Security and. If you would like the paycheck calculator to calculate your gross pay for you enter your hourly rate regular hours overtime rate and overtime hours. Use this calculator to help you determine your paycheck for hourly wages.

Then add the employees base hourly pay rate and select their overtime rate. Enter your current payroll information and deductions then enter the hours you expect to work and how much you are paid. - In case the pay rate is hourly.

Your gross pay will be automatically. -Overtime gross pay No. For an even smoother experience sign up for Hourly Payroll Time Tracking and turn a day of payroll headaches into a few minutes of payroll bliss.

Follow crew shifts easily and reliably. Discover ADP Payroll Benefits Insurance Time Talent HR More. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Divide the employees daily salary by the number of normal working hours per day. 1200 40 hours 30 regular rate of pay. RM50 8 hours RM625.

-Total gross pay. Ad Compare This Years Top 5 Free Payroll Software. Then enter the hours you.

This federal hourly paycheck. Ad The 1 Restaurant Scheduling Software For Shift Managers. Of overtime hours Overtime rate per hour.

You can claim overtime if you are. The overtime calculator uses the following formulae. Create Your Free Account Today.

Next divide this number from the. Trusted By 700000 Restaurants Pros. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

How do I calculate hourly rate. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then.

Weekly Time Record Time Sheet Printable Sign In Sheet Template Attendance Sheet Template

Payroll Template Free Employee Payroll Template For Excel Payroll Template Payroll Spreadsheet Template

What Is Annual Income How To Calculate Your Salary

Pin On Humor

Free Time Card Calculator For Excel Templates Printable Free Card Templates Free Card Templates

Employee Daily Report Template 3 Templates Example Templates Example Report Template Progress Report Template Progress Report

Estimate Your Grosspay Including Labor Hours Rate And Overtime With The Gross Pay Calculator Http Pay Calculator Mortgage Estimator Scientific Calculator

Calculate Payroll And Track Timecards Timesheets Attendance And Absences For Your Employees Payroll Template Bookkeeping Templates Payroll

23 Employee Timesheet Templates Free Sample Example Format Download Timesheet Template Templates Printable Free Home Health Aide

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

Weekly Timesheet Calculator Blue Timesheet Template Words Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Employee Training Schedule Template Excel Elegant Yearly Training Plan Template Excel Free Weekly Schedule Excel Templates Excel Calendar Employee Training

Payroll Calculator In Python Payroll Calculator Advertising

Pin Page

Pin On Free Templates

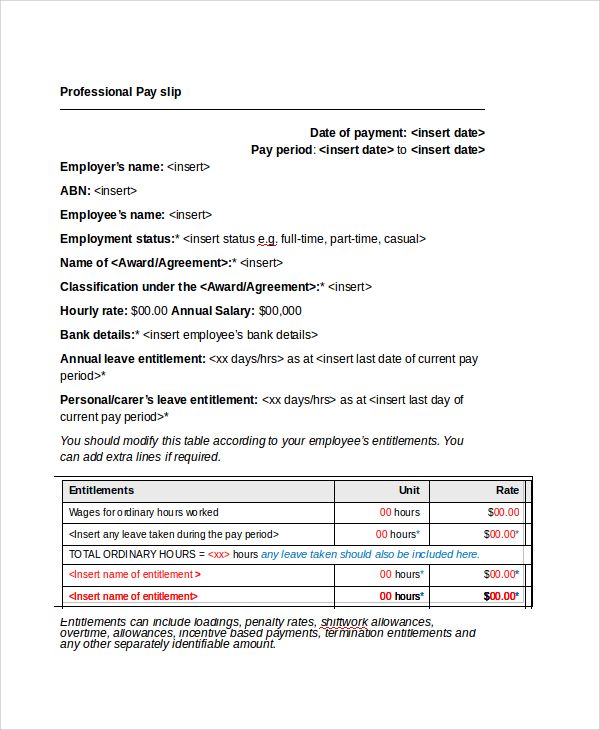

Payslip Templates 28 Free Printable Excel Word Formats Templates Words Word Template